Updated - June 18, 2022 at 08:14 PM.

At the current market price of about ₹ 607, the stock trades about 5.5 times its FY22 earnings

By Nalinakanthi V

Investors with a two-to-three year investment horizon and moderate risk appetite can consider investment in the stock of fertiliser and chemical manufacturer Gujarat Narmada Valley Fertilizers and Chemicals Ltd (GNFC). Having started off as a fertiliser player, in 1976 at Bharuch in Gujarat, manufacturing urea and ammonium nitro phosphate (NPK 20:20:0:0) fertiliser, the company expanded into industrial chemicals and petrochemicals.

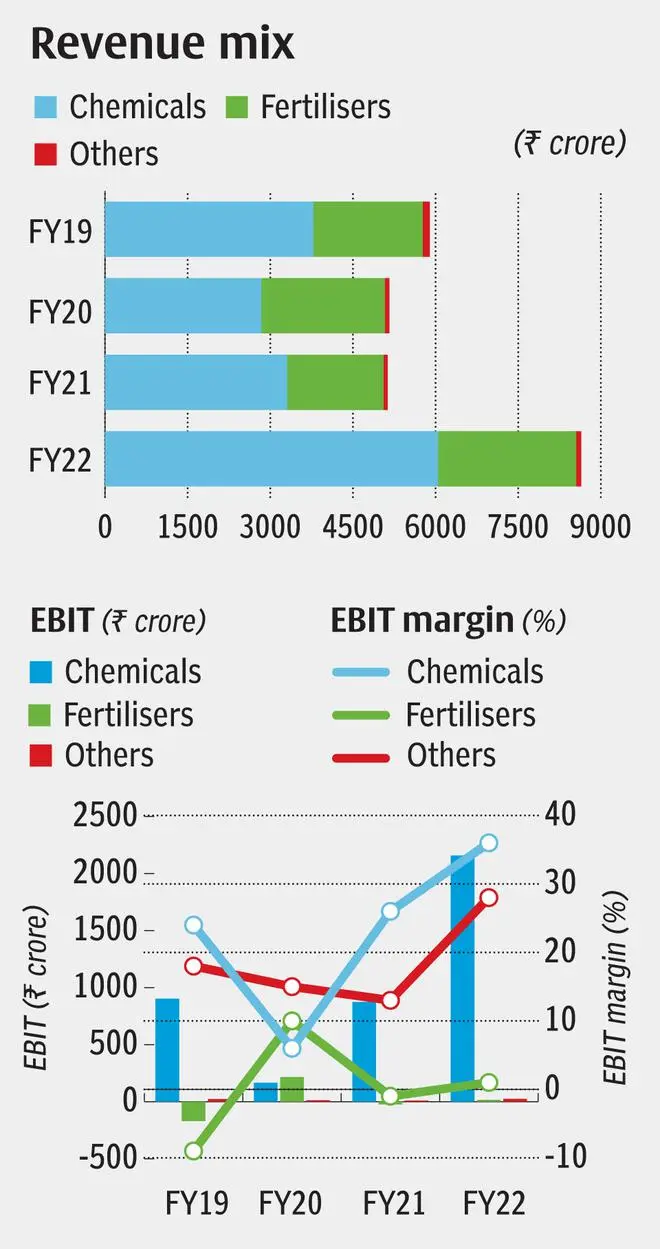

While the fertiliser segment (29 per cent of revenue in FY22) has lent stability to revenues and cash flows, the chemicals segment (70 per cent of revenue in FY22) has been the key growth driver for the company over the last several years. GNFC, over the years, has been channelising its investments to strengthen its chemicals business, which has helped the company achieve leadership in select products.

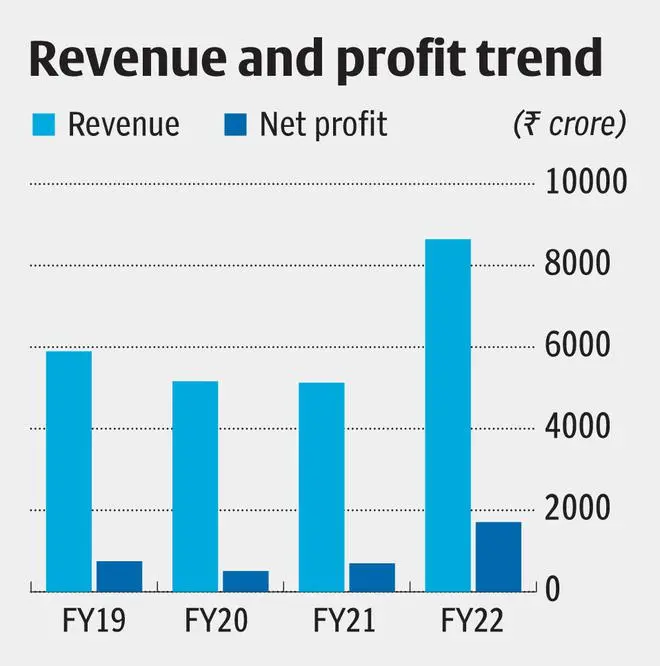

The past fiscal (FY22) was a blockbuster year in terms of revenue and profits, thanks to the sharp increase in the global prices of key products such as Aniline, toluene di-isocyanate (TDi), Weak Nitric Acid and Acetic acid on the back of supply disruptions from China, on account of covid lockdown and ongoing geopolitical issues. While the current fiscal will see moderation in the prices of these chemicals as compared to FY22, as supply from China resumes, the chemicals business should continue to deliver healthy double-digit growth over the pre-covid revenue and profits (FY20) in the current year. The company’s expansion of Concentrated Nitric Acid (by 50,000 TPA) which will be operational this year, will also support growth.It has planned capex of over ₹ 4200 crore, which will support long term growth of the company. At the current market price of ₹ 606, the stock trades about 5.5 times its FY22 earnings. In upcycles, the stock has traded between 8-10 times its earnings.

We believe GNFC to be a good diversification bet for investors with a moderate risk appetite and medium-term investment horizon for three reasons.

Chemicals business

First, the company’s chemicals business which has been the major growth kicker should continue to grow at a healthy pace in the medium term, though FY23 may see some moderation of the profit and revenue compared to the previous year, given that FY22 performance was driven by one-off global factors, which may or may not repeat. The company enjoys leadership in products such as TDi, (meets almost two thirds of the country’s demand), formic acid (caters to half of India’s need), aniline (a third of India’s demand) and is a key player in other products such as Ammonium Nitrate Melt and Technical grade Urea. GNFC’s expansion plans in key products coupled with its expertise in deciding on the optimal product mix based on market conditions to maximise revenue and profit and integrated nature of its chemical portfolio, will drive growth in the near-to-medium term. For instance, the company has the flexibility to sell Concentrated Nitric Acid directly or convert it into TDi and sell, depending on the market and price dynamics. This flexibility will help GNFC optimise its profits. The global prices of TDi and Aniline are seeing some pressure, due to Chinese supply coming back into the market. According to a data compiled by Chemanalyst, the price of TDi has fallen from ₹ 275/ kg in May to about ₹ 245/ kg in June.Similarly Aniline price for India has reduced from ₹ 178/kg in May 2022 to about ₹ 168 / kg in June. However, other chemicals such as Acetic acid have remained stable.The management expects the prices of weak nitric acid, Ammonium nitrate melt and Concentrated nitric acid to remain strong in the current fiscal too.

Capacity additions

Besides, the deftness in choosing between products, capacity additions will drive the company’s growth in the near to medium term. GNFC has completed debottlenecking of its TDi 2 plant (which will add 10,000 tonnes per annum) and formic acid (6800 tonnes per annum) at Dahej and Bharuch facility respectively. Further, the company is augmenting its Concentrated Nitric Acid capacity by 50,000 tonnes per annum and adding 4 MW solar power plant, both of which will come on stream by third quarter of the current fiscal.These will support growth in the near to medium term.

Long-term growth story

Second, the company has planned new projects as part of its medium to long term growth story. This includes Polycarbonate facility at a cost of ₹ 2500 crore and green hydrogen facility which will entail spend of ₹ 400 crore. The project proposal is likely to be taken to the board sooner and will likely take 3 years to commence operations.

Proposals that have already been approved by the board are under progress include enhancing ammonia capacity by 50,000 tonnes per annum, Weak Nitric Acid capacity by 2,00,000 tonnes per annum and Ammonium Nitrate Melt by around 1,50,000 tonnes per annum, all of which will start accruing to company’s revenues by 2025-26.

No debt, surplus cash

Finally, besides core business, the company is sitting on significant cash and has a good investment book too. The total cash, bank and deposits on the books as of March 2022 stood at ₹ 3682 crore. This includes deposits worth ₹ 2400 crore in Gujarat State Financial Services, which at 5.25 per cent annualised interest alone should add ₹ 6 per share on a post-tax basis. The investment book of GNFC as of March 2022 was ₹ 1222 crore. The company last year generated cash flow of ₹ 1967 crore from operations. In the pre-covid years, the company generated cashflows ranging between ₹ 1000 and ₹ 1500 crore. In an increasing interest rate environment, companies such as GNFC which solid cash flows and zero debt will have a competitive edge over others.

GNFC reported stellar numbers in the recent FY22 fiscal. The company’s total revenue grew 65 per cent to ₹ 8852 crore, compared to ₹ 5366 crore in FY21. Operating profit for the year rose faster, thanks to better margins on key chemicals such as Ammonium nitrate melt, technical grade urea and concentrated nitric acid.Operating profit grew 137 per cent to ₹ 2383 crore, vis-à-vis ₹ 1003 crore in FY21. Net profit for FY22 was higher by 145 per cent at ₹ 1710 crore, compared to FY21.

Related Topics

- stocks and shares

COMMENT NOW

COMMENT NOW